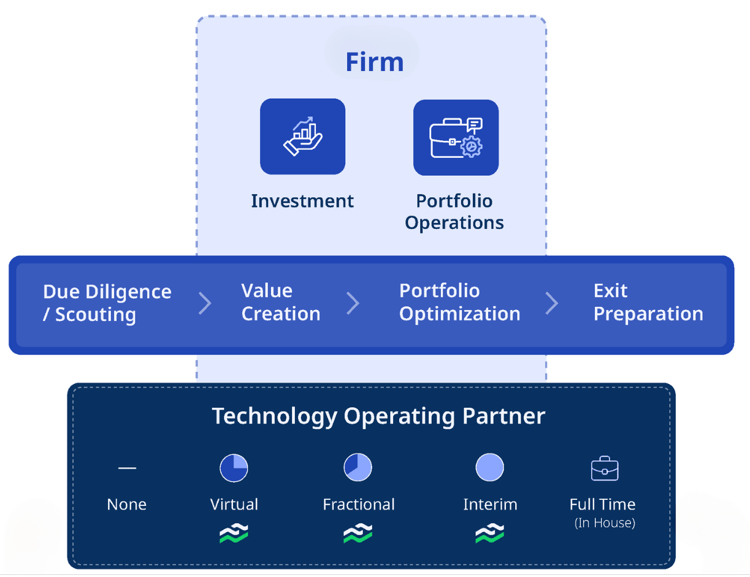

Interim CIO Services for an Equity Carve-Out

Global P/E Firm acquires a military subcontractor who builds and maintains engines for the US and Canadian governments

Fortium brought a military background with knowledge of sell-side transactions and regulatory requirements. They designed and implemented a new stand alone infrastructure within the 6 month target date.

.png?width=2000&height=1600&name=PE%20site%20graphics%20(1).png)